The following article is a covered call trade the firm executed in BlackBerry stock during Q1 2021. This article is not a solicitation of BlackBerry stock nor a “covered call” trading strategy. For more information, contact Sanju at ssubnani@sinvestsllc.com.

Written by Sanju Subnani

The Right Price

When holding stocks or bonds in a portfolio the firm does not own the assets of the underlying company.[1] Instead, the firm is carrying risk. The risk to the firm is the price paid for shares of stock. When the firm buys shares of a publicly-traded company, the firm aims to pay the lowest price possible because the shareholder owns the share, not a claim on the company’s physical assets. The firm believes “intrinsic value” and “shareholder equity” does not physically exist. The bond or shareholder of a publicly-traded company never receives a physical piece of the company’s property. Therefore, the firm believes paying a high double or triple-digit price for shares of common stock is unjustified. During 2017 – 2018, the firm began purchasing shares of BlackBerry common stock between $6 – $11. The firm’s median price range for BlackBerry shares is $8.50. The firm believed shares of BlackBerry stock were undervalued despite new management and a turnaround strategy. A copy of the firm’s internal stock report regarding BlackBerry is provided.[2]

Covered Call

A covered call is a two-part transaction. The first transaction involves purchasing 100 shares of stock. The first transaction creates a debit or cost basis for the investor. The second transaction involves selling 1 call option contract against the 100 shares of stock. The second transaction creates a credit or income to the investor.[3]

For example, suppose an investor purchases 100 shares of ABC stock at $10 and simultaneously sells the 11-strike call option for $1. If the stock goes above the 11-strike call option by its expiration date, the investor must sell the stock at $11. The investor will earn a total profit of $2 ($1 price gain + $1 call credit). As a result, the investor is 100% in cash and does not own stock. If the stock falls below the 11-strike call option by its expiration date, the investor keeps the shares of stock and $1 credit. This will bring the investor’s cost basis down to $9. The chart below summarizes the investor’s hypothetical trade at the end of the month if ABC stock rallied above the $11-strike to $50 or fell to $1. Ideally, the investor would want ABC to fall below $11 to hold on to the shares however take in a higher credit of $9 or $10 instead of $1. The investor keeps the $1 call option credit regardless of either outcome.

| ↑ ABC goes to $50 ↑ | ↓ ABC falls to $1 ↓ |

| Profit: $2 | Profit: $1 |

| Position: No Stock | Position: 100 shares of stock with a reduced cost basis of $9 |

Reddit Rush

Following the pandemic shutdown of 2020, BlackBerry shares fell below a price base of $5 – 10 formed since 2013. BlackBerry fell to a low of $2.70 on March 18, 2020. Following the economic re-opening, BlackBerry shares traded back above $5 in December of 2020. At the beginning of 2021, users began posting positive comments about BlackBerry stock on a popular online forum, Reddit.com.[4] The stock price rallied from $6.50 on January 4, 2021, to $28.77 on January 27, 2021. Below is a chart of BlackBerry’s price action during 2020 and the Reddit rush of 2021.

Volatility Squeeze

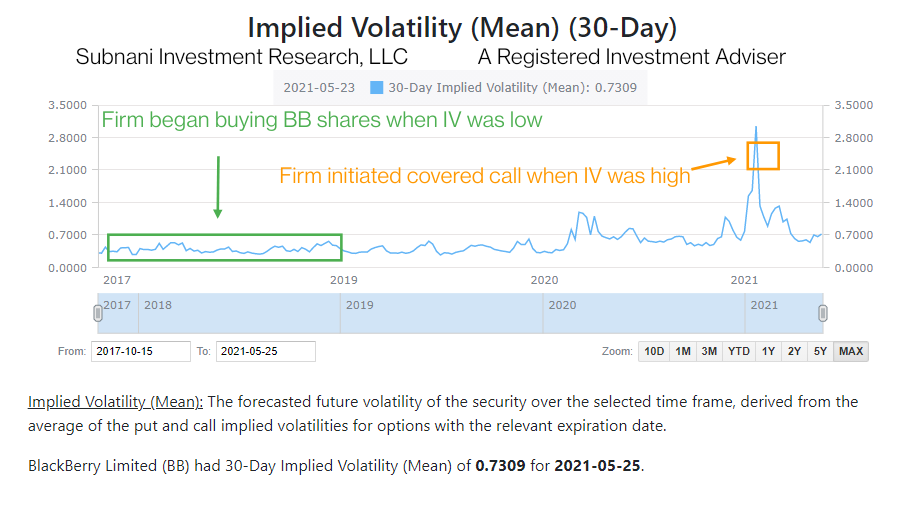

Speculators anticipating BlackBerry shares to continue trading above $30 were aggressively buying call options. Call options rise in value when the stock price rises. Implied volatility (IV) is the “level of expensiveness” of call options. Implied volatility is directly influenced by the supply and demand for calls. Implied volatility rose substantially because of increased call option buying. High levels of implied volatility will result in expensive call option prices. Lower levels of implied volatility will result in cheaper call option prices.[5] A chart of BlackBerry’s 30-day implied volatility from 2017 – 2021 is provided below. During 2017 – 2018, the firm purchased shares of BlackBerry stock due to the potential for undervaluation. The firm’s cost basis or debit of BlackBerry shares ranged between $6 – 11. At the time, implied volatility was low and call option prices were cheap (green box). During the Reddit rush, implied volatility rose significantly, and call options became expensive (orange box).

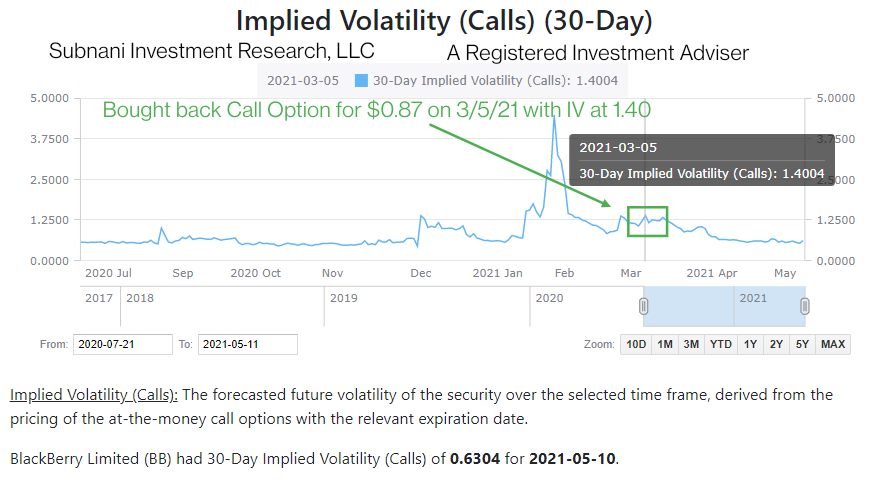

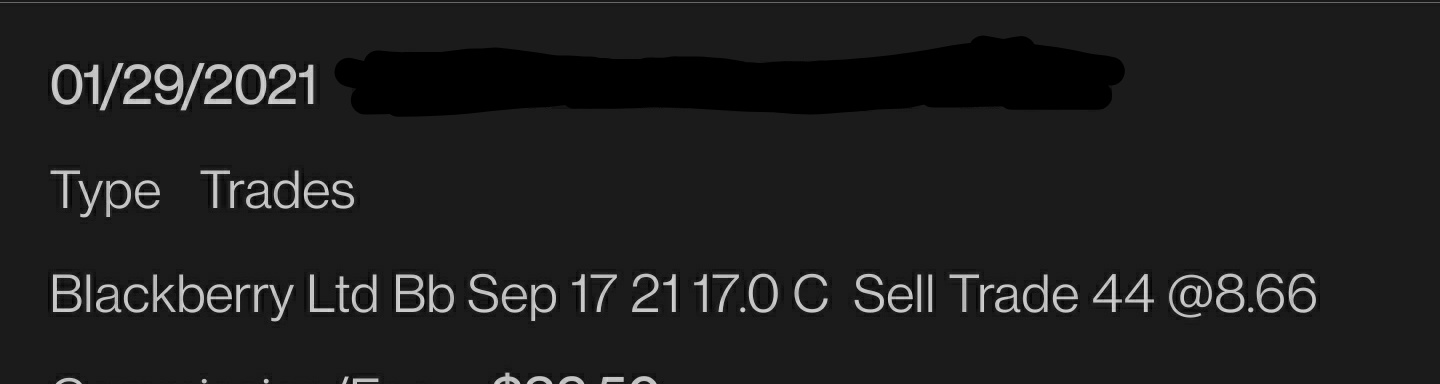

Below are charts of BlackBerry’s 30-day call option implied volatility. Call option prices were trading 3x more expensive than normal due to the speculative rush. The firm’s goal is to recoup the debit from the share purchase by generating a large enough credit from the sale of the call option. The firm sold call options against its stock on January 29, 2021, for an average of $8.66 per contract.

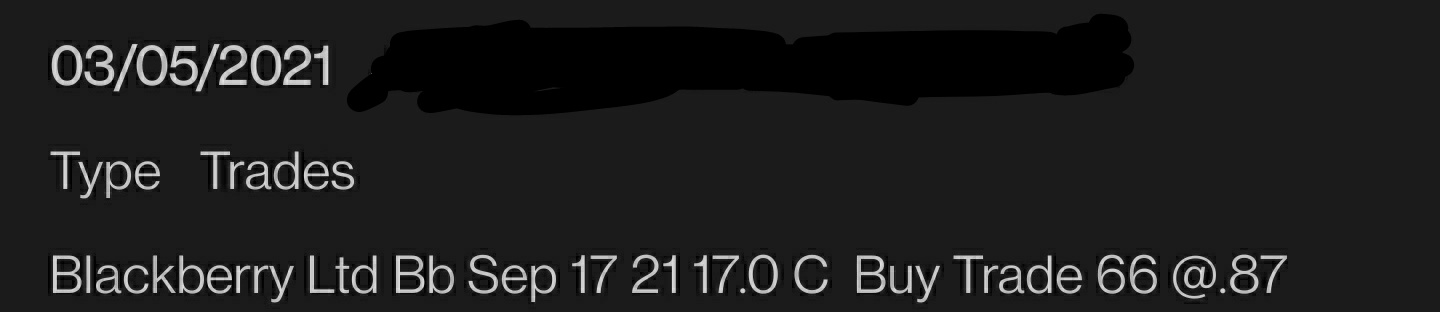

Upon selling the 17-strike call option, the firm took in a credit of $8.66. On January 29, 2021, BlackBerry shares closed at $14.10. On March 5, 2021, BlackBerry shares closed at $9.45. The firm exited the covered call trade on March 5, 2021. The firm closed the trade for $0.87, netting a total credit of $7.79 ($8.66 – $0.87).

The Outcome

Below is a table breaking down the firm’s position if BlackBerry stock had rallied above the $17-strike call to $50. If BlackBerry rallied to $50, the firm would have to sell its stock at $17. The firm would net a total profit of $17.16 ($8.50 price gain + $8.66 call option credit) but not own any shares. The table uses the firm’s median cost basis of $8.50.

| ↑ If BlackBerry went to $50 ↑ |

| Profit: $17.16 |

| Position: No Stock |

However, BlackBerry stock fell beneath $17 shortly after the covered call trade was initiated. Below is a table displaying the firm’s adjusted price range after exiting the covered call trade. The firm owns BlackBerry shares with a newly adjusted cost basis of $0.00 to $3.34.

| Pre-trade purchase price: $6.00 to $11.00 |

| $11 – $7.66 call option credit = $3.34 |

| $7.66 call option credit – $6.00 = $0 |

| Post-trade purchase price: $0.00 to $3.34 |

Subnani Investment Research, LLC uses volatility to the firm’s advantage as a way of hedging risk or reducing cost basis for its clients. Volatility is the only asset class. For more information regarding this article or to become a client, contact Sanju at ssubnani@sinvestsllc.com.

References:

[1] https://sinvestsllc.com/the-shareholder-ownership-myth/

[2] file:///C:/Users/ssubn/Desktop/blackberry/blackberry%20stock%20report.pdf

[3] https://www.thebalance.com/short-covered-call-1031344

[4] https://investorplace.com/2021/02/bb-stock-blackberry-looking-beyond-the-reddit-memes/

[5] https://www.investopedia.com/articles/optioninvestor/08/implied-volatility.asp