Written by Sanju Subnani

Fannie Mae & Freddie Mac

Fannie Mae became a government-sponsored entity (GSE) after the 1930s Great Depression. The US government formed Fannie Mae in 1938 to purchase defaulted mortgages from banks’ balance sheets. Banks use the cash from the sale of the mortgage to make more loans. Fannie Mae securitizes mortgages making them sellable to endowments and other institutional investors.[1] Fannie Mae makes it easier for banks to lend money to low- to middle-income buyers who are unlikely to have a high credit rating. Fannie Mae acts a secondary market for mortgages like how the New York Stock Exchange is a secondary market for stocks and bonds. Fannie Mae’s mortgage business grew large enough in the 1960s to warrant the creation of a publicly traded company. Freddie Mac was created to support Fannie Mae’s mortgage operations as the US housing market grew.[2]

A Single Mortgage Rate

If someone bought a house before the 1980s, the interest rate on the mortgage was not clearly defined. A single mortgage rate had not been established until the mid-1980s. Homebuyers in different regions paid different rates. Younger clients with less savings moved to the underdeveloped western US while those with larger savings lived in the east. In the late 1970s, a borrower in San Francisco or Los Angeles paid a mortgage rate 2% higher than a borrower in New England. Banks with less financial strength and low deposits had their borrowers pay more in interest and vice versa. Fannie Mae’s mortgage business ensured a single mortgage lending rate became established during the high interest era of the 1970s.[3]

Back In Business?

During the mortgage bubble of 2008, Fannie Mae suffered losses which prompted Congress to draft the Recovery Act. As a result, the Federal Housing Finance Agency (FHFA) was created to act as a conservator or receiver of Fannie Mae during times of economic distress. In July 2008, Congress approved a bailout that included a key measure; approval for the Treasury Department to buy shares of Fannie’s and Freddie’s stock to support stock price levels and allow the entities to continue to raise capital on the private market. The US Treasury pledged $100 billion each to purchase Fannie and Freddie’s preferred shares and receive fixed-rate dividends.[4]

As of January 2021, the Treasury Department and FHFA amended the terms of the preferred stock purchase agreements made in 2008. The Treasury increased its pledged capital of $100 billion to $200 billion each.[5] The Treasury will allow Fannie and Freddie to issue additional common stock when the following condition is met: “First, the Treasury must have exercised in full its warrant to acquire 79.9% of the Fannie & Freddie’s common stock, and second, all material litigation relating to the conservatorship must have been resolved or settled. Treasury will permit up to $70 billion in proceeds of stock issuances by each GSE to be used to build capital.”[6] “Those commitments ensure that the Treasury will provide investments in the Enterprises so that each remains solvent and can continue to provide liquidity and stability to the mortgage market, despite its lack of risk capital.”[7]

As of 2022, interest rates are on pace for the steepest hikes in recent history making it increasingly difficult to obtain a mortgage for low- to middle-income homebuyers. However, in September, Bank of America began offering mortgages to first-time homebuyers that do not require a down payment, minimum credit scores, or closing costs in a new program to boost homeownership amongst low-income citizens.[8] In the past, if a spouse had a credit score beneath Fannie Mae’s required 620, the couple would not be eligible for a mortgage. As of September, new credit score rule changes allow spouses to average their credit scores together for improved mortgage eligibility.[9] In November, Fannie Mae completed its 11th credit risk transfer of $343 million in mortgage risk to private insurers and reinsurers. “The record amount of coverage that Fannie Mae acquired through its Credit Insurance Risk Transfer (CIRT) program this year further demonstrated the resiliency of this credit risk transfer vehicle. The eleven transactions covered $213 billion of single-family loans and secured $7.2 billion of coverage, which was more than 2.7 times the previous single-family CIRT record for coverage acquired in any single year.”[10]

The Options Casino

When a call option is purchased, a dealer or market maker must take on the opposite side. The dealer becomes short the call option or otherwise short the underlying stock. To neutralize the short risk exposure, the dealer must purchase the underlying stock resulting in a price surge. When purchased call options expire, dealers who are long the stock must aggressively sell resulting in a price decline.[11] During the Reddit Rush of 2021, speculators aggressively purchased call options on GameStop, AMC, and BlackBerry’s stock. As result of large call option buying market makers were forced to buy shares of underlying meme stocks. GameStop stock increased by 2500% from $2.50 to $350 pre-stock split.

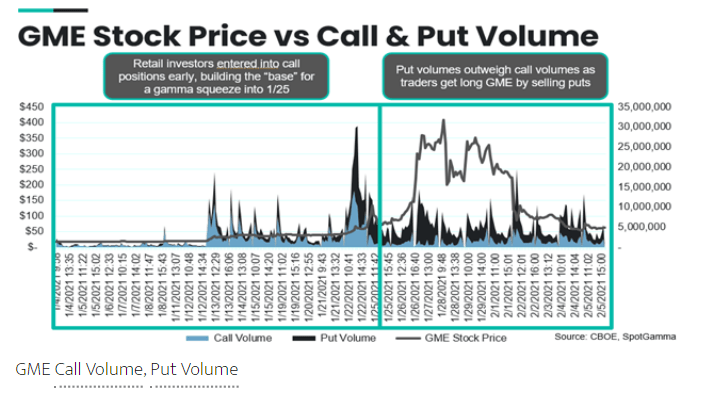

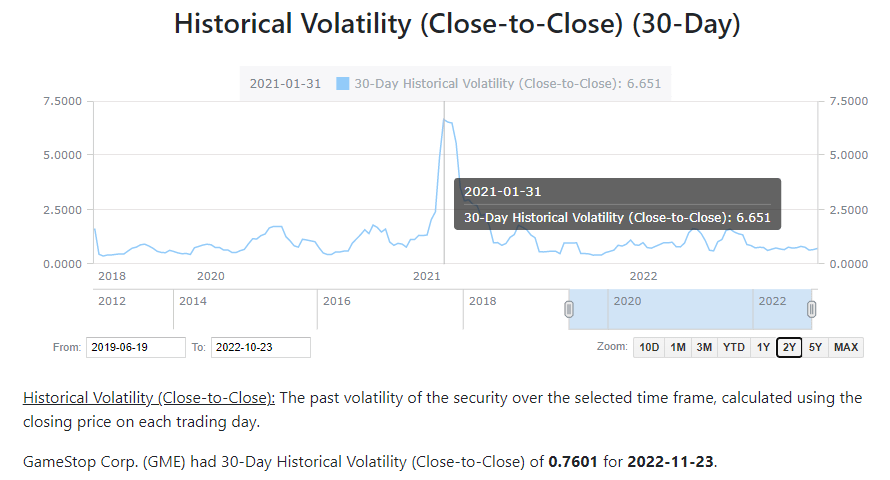

Pictures below show that three events occurred in GameStop which signaled the turning of the share price. The first event was a surge in call and put option volume on 1/22/2021 in the first blue box, second a surge in GameStop’s share price on 1/28/2021 in the second blue box[12], then finally a spike in the price of call options of over 6.5x than normal on 1/31/2021 in the second picture. After these events, an opportunity to initiate a covered call position or otherwise collecting winnings and leaving the table presented itself. The firm’s most recent covered call trade in BlackBerry can be found here: https://sinvestsllc.com/the-blackberry-covered-call-trade-nysebb/

Place Your Bets

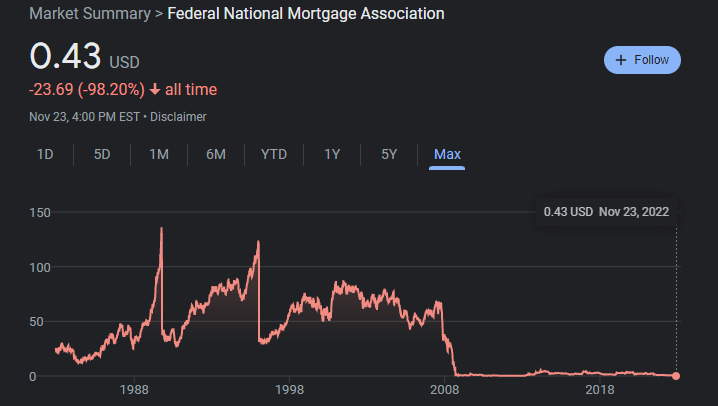

Subnani Investment Research, LLC calculates that the odds of being dealt a winning hand of Blackjack decreases from 9.6% to 2.8% starting with the least amount of players to a full table.[13] Using the stock market in comparison, an up day in a stock is like getting dealt a Blackjack. The firm compares a Blackjack table of just the dealer and one player to a stock that is trading under $1 with no listed options; speculators are not aggressively purchasing call options and the odds of getting winning hands are mathematically the highest. When options become listed, the firm anticipates a surge in Fannie’s share price like the price action in 2021 Meme stocks.

Fannie Mae’s common stock price closed at $0.43 on November 23, 2022, with no listed options. Subnani Investment Research, LLC asserts there aren’t any players sitting at the Fannie Mae Blackjack table. The firm seeks to use the three major GameStop events mentioned above as a method for producing the trade result in BlackBerry.[14] The firm is aggressively purchasing Fannie Mae common stock for its current and prospective clients at the current price level. To become a client, contact Sanju via direct message.

[1] https://www.fhfa.gov/about-fannie-mae-freddie-mac

[2] http://content.time.com/time/business/article/0,8599,1822766,00.html

[3] https://www.washingtonpost.com/archive/realestate/2002/10/12/mortgage-memory-lane/fde4a065-f1b4-4277-9f33-ed5706c09ed5/

[4] https://www.supremecourt.gov/opinions/20pdf/19-422_k537.pdf

[5] https://home.treasury.gov/system/files/136/Executed-Letter-Agreement-for-Fannie-Mae.pdf

[6] https://home.treasury.gov/news/press-releases/sm1236

[7] https://www.fhfa.gov/Conservatorship/Pages/History-of-Fannie-Mae–Freddie-Conservatorships.aspx

[8] https://www.bankrate.com/mortgages/bank-of-america-zero-down-mortgage-minority-neighborhoods/

[9] https://www.fairwayindependentmc.com/articles/new-credit-score-rule-will-help-dual-income-households-buy-a-home

[10] https://www.prnewswire.com/news-releases/fannie-mae-executes-its-eleventh-and-final-credit-insurance-risk-transfer-transaction-of-2022-on-10-1-billion-of-single-family-loans-301685465.html

[11] https://www.efmaefm.org/0efmameetings/efma%20annual%20meetings/2013-Reading/papers/EFMA2013_0022_fullpaper.pdf

[12] https://spotgamma.com/gme-gamma-squeeze/

[13] The weighted probability of getting an ace is 4 ÷ 52 = 7.6% * 50% or 3.8%. The weighted probability of getting a 10 or face card is 16 ÷ 52 = 31% * 50% or 15.5%. Adding the two probabilities together would equal about 19.3%. Between the dealer and one player, the probability of getting dealt a Blackjack is 9.6% (19.3% * 50%). When 7 total players sit at the table, the probabilities of getting a perfect hand drop to 2.8% (19.3% * 1/7)