Written by Sanju Subnani

Passive investing is simple; buy an index fund and hold it. Timing the stock market is discouraged. Dollar-cost averaging (DCA) or consistently investing a fixed amount of money at fixed time periods is often recommended. Stocks and bonds are a series of cash flows to its holder. As stocks and bonds appreciate, dividends and interest can be reinvested or held in cash. Dividends and interest are forms of cash flows that a passive investor can harvest without selling the underlying stock or bond.

Active investing involves buying stocks that may be undervalued compared to its peers or the rest of the stock market. Active money management times the entry of an investment using chart patterns, technical indicators, and macro analysis. An investment manager picks investments then manages risk by hedging. Hedging an investment produces a cash flow or “dividend” via the use of the options market. In some cases, an active investor can harvest the option cash flow without selling the underlying stock.

The difference between the two forms of investing has its pros and cons. Active money management requires hiring an investment manager capable of trading options and identifying undervalued companies while passive investing does not. Index investing does not produce dividends sufficient to hedge against large declines. Active money management times investment entries which can lead to lower entry prices and higher returns. Passive investing buys at any price yielding less returns.

Different Flows for Different Folks

Different investments can create cash flows to an investor that can either be spent or reinvested. Once an investment is purchased, an investor can create a series of cash flows that will reduce the cost over time. A chart of common investments and its cash flows are provided below.

| Type of Investment | Type of Cash Flow | Type of Investor |

| Stocks & Bonds | Dividends & Interest | Passive Investor |

| Residential / Commercial Real Estate | Airbnb or Rental Income | Real Estate Investor |

| Paid-off Home | Reverse Mortgage Income | Investor not wanting to transfer home to heirs |

| Raw Land | Hunting Lease or Farming | Real Estate Investor |

| Exotic Cars or Collectibles | Car Rental Income or Other Income | ‘Exotic’ Investor |

| Stocks | Covered Call Option Premium | Active Trader – Subnani Investment Research, LLC |

Using real estate to produce rental income has its pros and cons. The investor has control over the appearance or curb appeal of the investment. However, real estate can have a high cost and using 10% down in the form of a loan to purchase a property conversely means the investor has taken on 10x the leverage. In the event tenants cannot be found and or the cost of the loan rises as interest rates rise, the investor may be forced to liquidate the property at a lower price. A purely negatively correlated real estate hedge does not exist so real estate investors take the entire loss.

A fully paid off home can be cash flowed by using a reverse mortgage. Reverse mortgages may not be suitable for everyone who has a paid off home. When retirees have low investment savings and do not want to pass their home on to their heirs, then a reverse mortgage might be suitable to provide additional income.

Since raw land is undeveloped, it is often the riskiest asset to purchase unless developments will be made. Hunting lease rentals or farming are ways of recouping the cost. The cost of raw land may be cheaper compared to land with a standing structure, however skills to harvest from the land are required. Exotic cars can be rented out in efforts to recoup the cost. Cash flows can be created if a market for renting out exotic items exists however its market may not have enough volume nor bids and its existence is unknown.

As mentioned above, stocks and bonds can produce dividends and interest to a passive investor aside from capital gains. The size of the dividend relative to the potential capital loss is generally not large enough to withstand declines. When passive investors become active, trading in and out of declining stocks is not hedging risk. The options market effectively provides experienced traders the ability to transfer the directional risk of a stock to another party. An update to Subnani Investment Research, LLC’s position in BlackBerry stock is provided below.

Update to Firm’s BlackBerry Trade

Subnani Investment Research, LLC relies upon using stock market movements to create a cash flow from covered call option trades. A covered call is when 100 shares of stock are purchased and its underlying call option is simultaneously sold against it. The call option premium or credit is a cash flow to the investor. The investor keeps the credit whether the stock is above or beneath the short call option. If the stock price is largely above the call option strike, then the stock must be sold.

Actively selling covered calls against stock to reduce the cost has pros that other common investment strategies do not. It can take years or decades to recoup the cost of a real estate property. It may take a few months to a year to recoup the cost of a stock via a covered call. Large spikes in the price of call options create expensive option premiums and high liquidity and volume means huge stock positions can be hedged within seconds. The firm’s BlackBerry Covered Call Trade is an example and can be found here: https://sinvestsllc.com/the-blackberry-covered-call-trade-nysebb/.

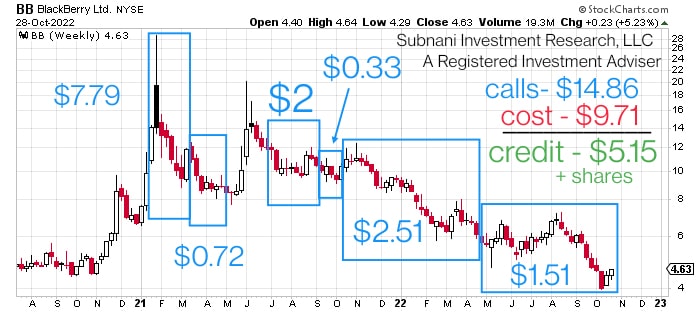

An update to the covered call trade in BlackBerry stock is provided below via a weekly chart that is marked with blue boxes. The six blue boxes represent covered call trades the firm entirely closed out for a gain during that period. The process involved selling a call against the existing stock, waiting for the stock to drop and the call option to lose value. The call was exited for a gain and the next call option was sold for another premium. The option premium totaled $14.86. The share price for the stock position was $9.71. As a result of the trades, three goals were achieved: The firm’s price in BlackBerry stock is now $0. A gain of $5.15 per share was collected. All shares are still owned with uncapped upside; the shares were never “called away.”

The Rise of Active Investment Management

Subnani Investment Research, LLC believes call option volatility is meant to be traded, not feared nor misunderstood. The stock and options market provide professional traders the ability to trade large amounts of capital and transfer risk in the most optimal scenario. The firm seeks to replicate the above result for current and prospective clients in any economic environment. To become a client, contact Sanju via direct message or at ssubnani@sinvestsllc.com.