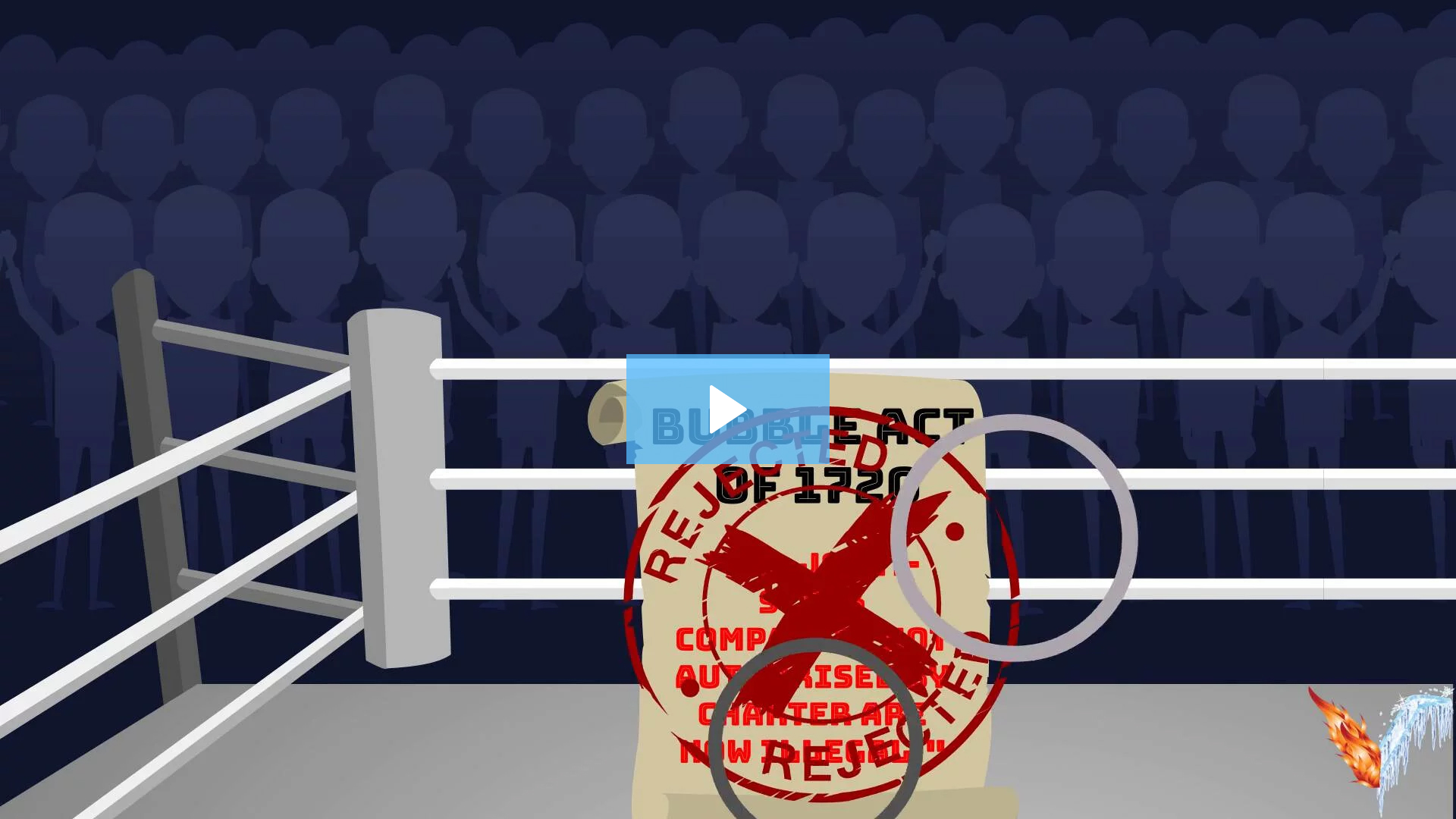

DING, DING! Legislation enters the ring against volatility in an attempt to try to suppress fear and greed. Legislation has been passed but fear and greed cannot be contained. History has shown when legislation steps in, investors simply hopped over to the next, “best” investment. During the South Sea Fantasy episode, the Bubble Act of 1720 was passed. The Bubble Act limited the amount of newly formed stock companies. As a result, the South Sea Company obtained more investor capital. Not only did this legislation stop speculation in other stocks, it prompted the South Sea bubble to grow even larger as investors had no choice but to pile their money into one company. After the repeal of the Bubble Act more than one hundred years later, investors jumped on the next train with a one-way ticket to Railway Mania. In another attempt to try and defeat volatility, Sarbanes-Oxley was passed in 2002. The passing of Sarbanes-Oxley was to prevent accounting fraud from arising which was one of the main factors that inflated the Dotcom bubble. However, this did not stop fear and greed as investors piled into subprime mortgages causing one of the biggest price bubbles to form and pop in the U.S. housing market. Volatility wins again! Click Bubble Videos below to see how investor psychology has repeated itself since 1636.