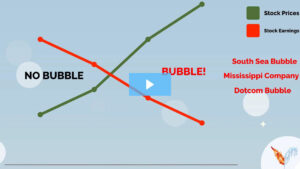

SaVvy investors believe money can take on 3 different forms: physical gold, cash, or stocks/bonds. As seen in Bubble Talk, investor’s greed prompted real estate to become highly correlated to stocks and bonds during the mortgage meltdown of 2008. SaVvy investors consider real estate to function similarly as stocks and bonds. During times of peak economic distress, stocks, bonds, and real estate returns become correlated, meaning portfolio protection is not achieved. When investors rush to either state, those particular states begin to rise in price. Once the price of the asset grows beyond its true fundamental value, a price bubble has formed. Price bubbles pop when investors rush away from that state abruptly. Since the Tulip Bubble Trouble of 1636, volatility has continued this 2-step cycle. Click Bubble Videos below to see how investor psychology has repeated itself since 1636.