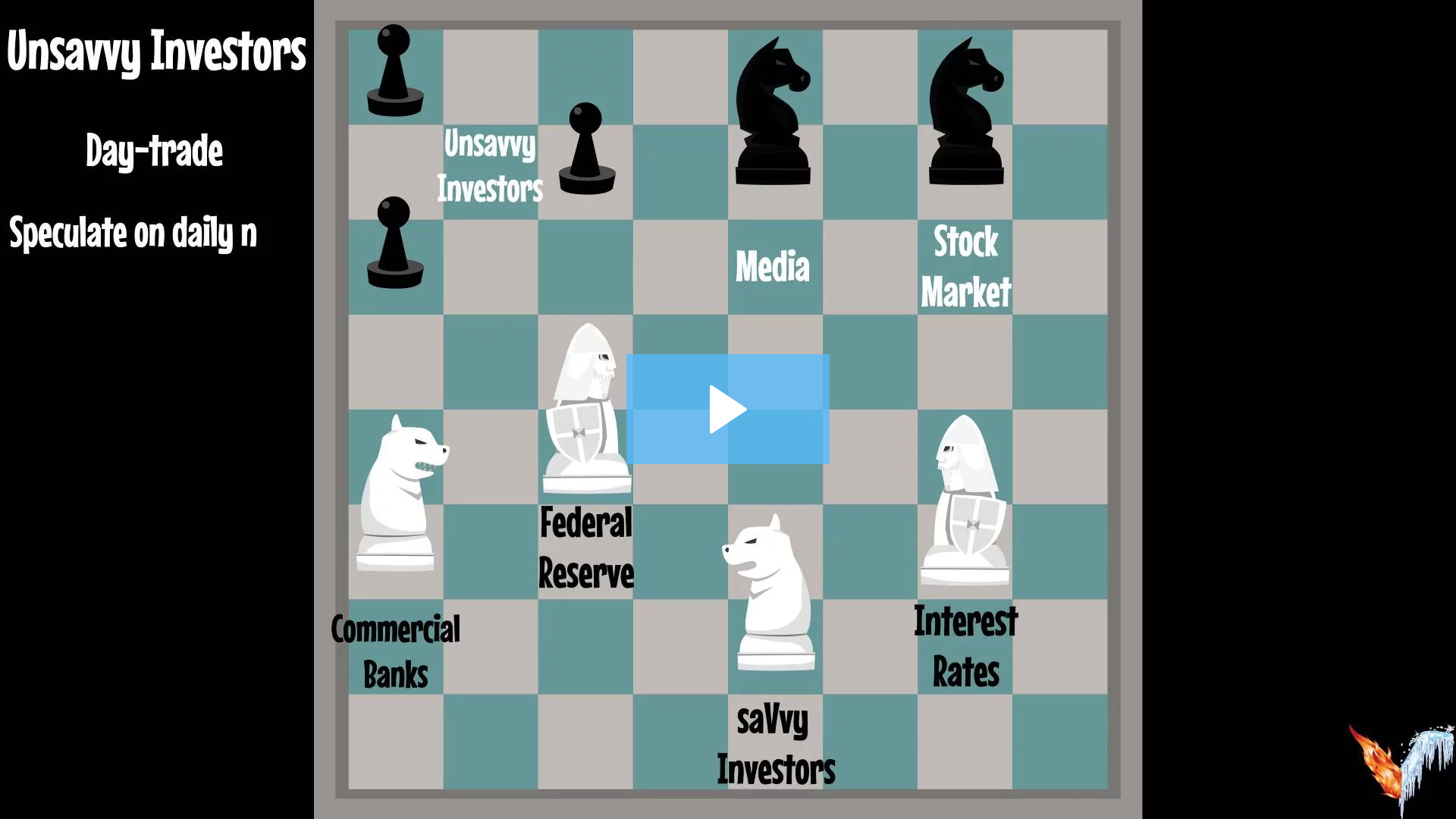

What is saVvy?

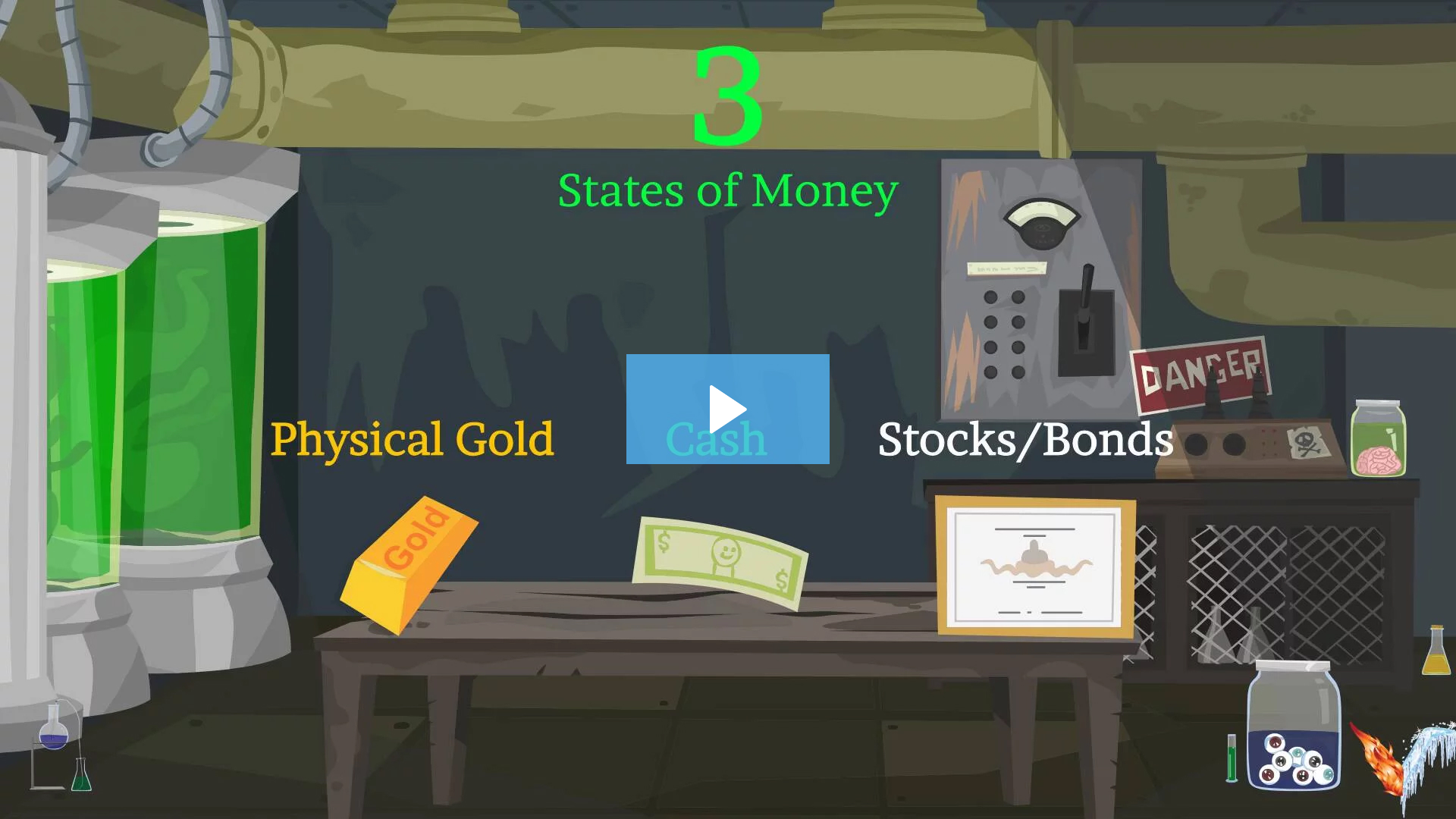

The mainstream’s traditional method of investing is called “Modern Portfolio Theory.” Modern portfolio theory states that by allocating money into bonds, stocks, and real estate an investor’s portfolio may be protected in the event a financial collapse occurs.