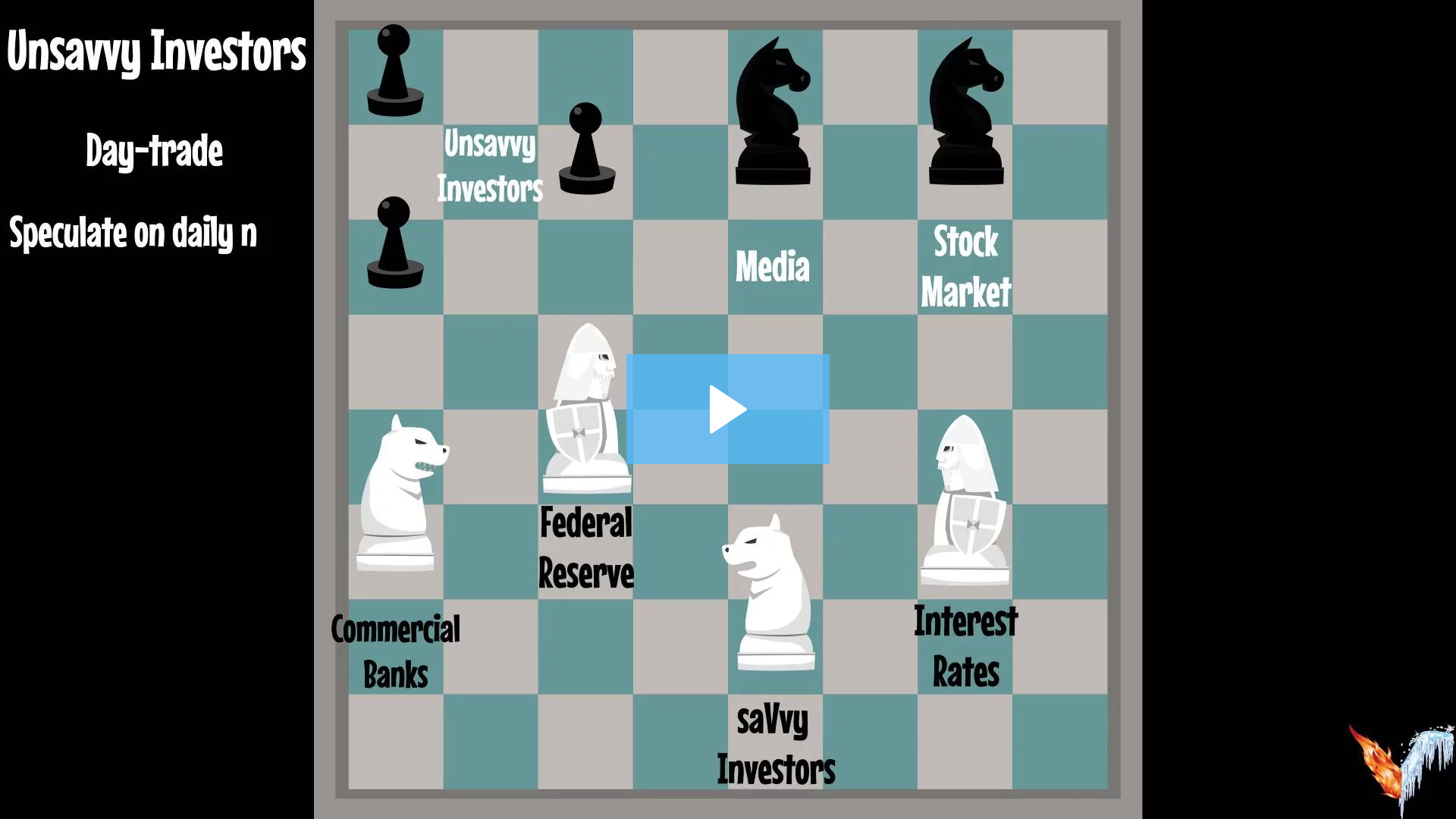

SaVvy investors see investing like a game of chess. Each piece in chess has a particular path it can move. The SaVvy investment perspective believes the major pieces in the financial markets follow the same logic. SaVvy investors consider the path each chess piece can move. Once an investor understands what each piece can do, they can better position their portfolio to take advantage of fire and ice, whenever it occurs. Unsavvy investors attempt to speculate on daily news to come up with a basis for making investment decisions. Unsavvy investors follow the media, whom SaVvy investors believe only reports on what the stock market does after it has done it. Trying to invest based upon news announcements results in unsavvy investors consistently investing at market tops and selling at market bottoms. Unsavvy investors fail to see the forest from the trees as the only thing that drives their investment method is daily profit and loss. This leads unsavvy investors to view the financial markets as a game of checkers rather than chess. SaVvy investors understand human emotion is the main driver behind bubbles forming and popping. Click Bubble Videos below to see how investor psychology has repeated itself since 1636.