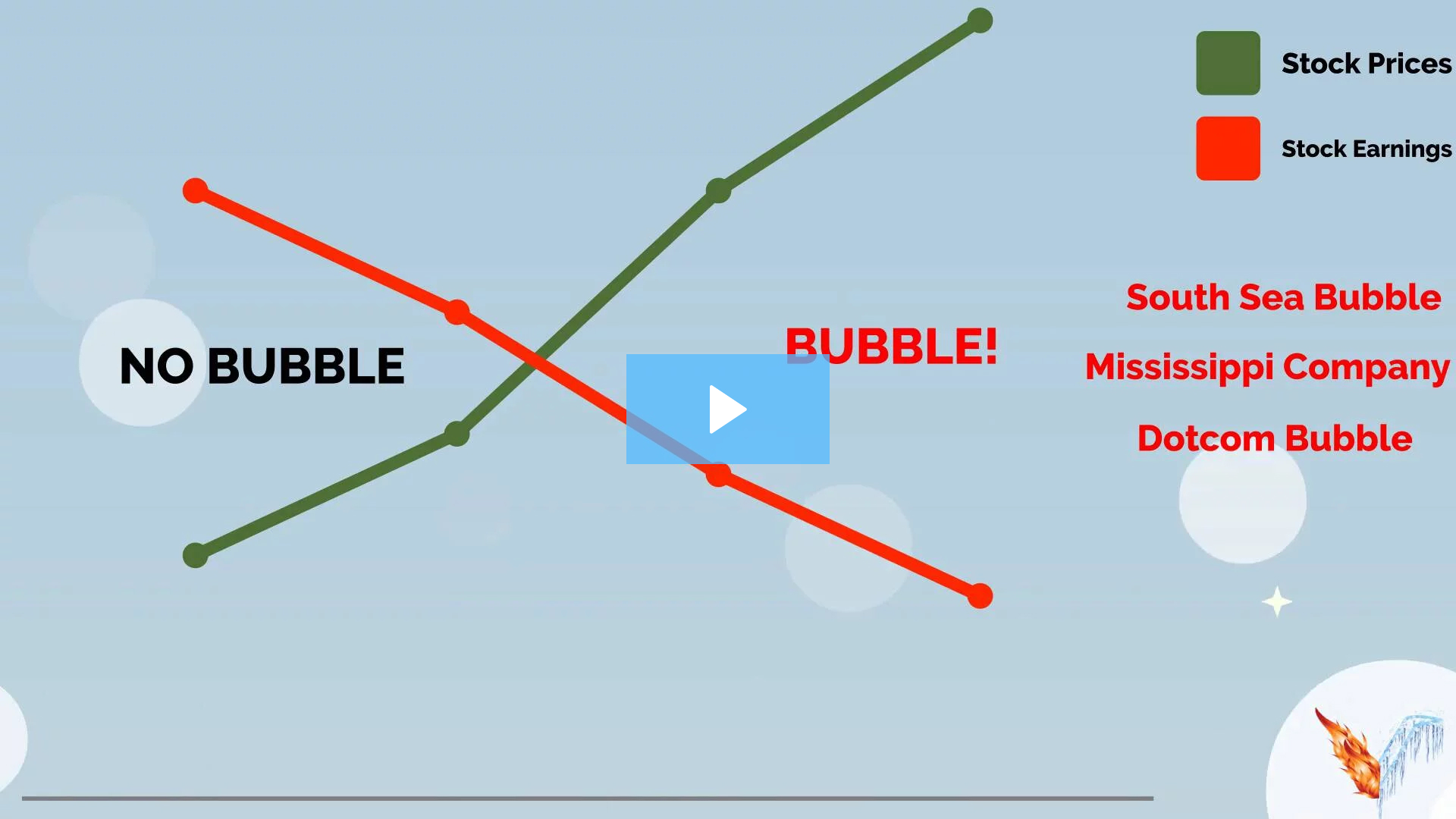

Bubbles form in stock prices when there is a disconnect between reality and fundamentals. In the case of stock bubbles, the disconnect forms when stock prices surpass stock earnings. The fundamentals that became disconnected from reality during the 2008 mortgage bubble was the borrower’s credit quality, size of loan and the borrower’s likelihood of paying that loan back. As home equity values grew, investors began borrowing from their homes to invest in the stock market. Once fear struck, stock prices and home values started moving in the same direction. The mortgage bubble caused a “fire” crash in stocks as investors rushed to cash when the financial system collapsed. Click Bubble Videos below to see how investor psychology has repeated itself since 1636.