Written by Sanju Subnani

MAINTAIN STRONG BUY

Fannie Mae: FNMA (OTCMKTS): Federal National Mortgage Association – $2.74

Price Target: $90

Fannie Mae

Two BUY recommendations were posted on November 26, 2022[1] and September 13, 2023[2] for Federal National Mortgage Association or Fannie Mae (FNMA) common stock. This post will analyze the conservatorship, Net Worth Sweep, Fannie Mae’s earnings, and provide a potential price target.

Conservatorship and Net Worth Sweep

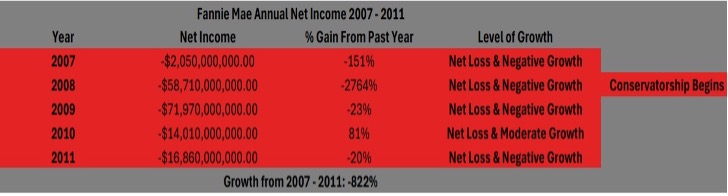

On September 6, 2008, the Federal Housing Finance Agency (FHFA) took full control over Fannie Mae and Freddie Mac. Major losses in 2007 and 2008 stemming from defaults in the mortgage market prompted the start of the government conservatorship. The conservatorship directed the FHFA to act as conservator to preserve and conserve the assets of Fannie and Freddie. Once Fannie and Freddie recovered its losses, it would be released from the FHFA’s control.[3]

The conservatorship included an agreement between the U.S. Treasury and Fannie Mae. The Treasury bought senior preferred stock in Fannie and Freddie in exchange for a $100 billion capital commitment to each company. In exchange, Fannie would pay the Treasury a 10% dividend. The capital commitment was increased to $200 billion and then ultimately raised to an unlimited amount through the end of 2012.

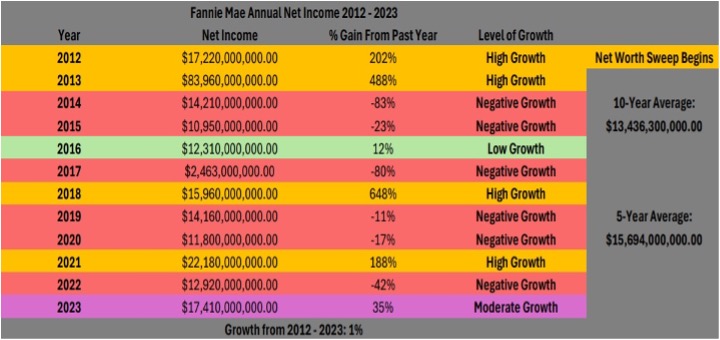

However, without notice to shareholders, on August 17, 2012, the Treasury and FHFA changed the agreement. The Treasury knew Fannie would make record profits in the future and directed the companies to pay 100% of its net profits to the Treasury instead of 10%.[4] On the first year of the net worth sweep in 2013, Fannie Mae posted its highest annual profit ever of $83.9 billion. As a result, Fannie and Freddie were forced to pay 100% of its profit or over $130 billion in cash dividends to the Treasury. Fannie and Freddie were forced to pay $111 billion more than what the original 10% dividend would have been. At the end of 2013, Fannie’s share price closed at $3.01.

Over a decade of class-action litigation led by Boies Schiller Flexner partner Hamish Hume claimed a historic victory on August 14, 2023, for Fannie Mae and Freddie Mac shareholders. A federal jury found the Net Worth Sweep violated the contractual rights of private shareholders of Fannie Mae and Freddie Mac.

Shareholders filed a class action lawsuit against the FHFA in 2013. “First filed in 2013, the lawsuit by Fannie and Freddie shareholders bounced between the trial and appellate courts over the next decade, with Hume arguing and winning a successful federal appeal in the D.C. Circuit in 2017. The case was finally heard by a federal jury in the fall of 2022, but that jury could not agree upon a unanimous verdict. The second time around, the jury issued a resounding and historic rebuke against the government’s overreach.”[5] Since the conclusion of the court proceedings the presiding judge has yet to finalize the verdict.

Make Fannie and Freddie Great Again

In his last term, President Donald Trump was trying to release Fannie and Freddie from conservatorship. “My Administration would have sold the government’s common stock in these companies at a huge profit and fully privatized the companies,” Trump wrote in a 2021 letter after he left office to Republican Sen. Rand Paul. “The idea that the government can steal money from its citizens is socialism and is a travesty brought to you by the Obama/Biden administration. My Administration was denied the time it needed to fix this problem because of the unconstitutional restriction on firing Mel Watt,” the FHFA director at the time, Trump said.[6]

Donald Trump won the election in November 2024 and is appointing a cabinet that is focused on the release of Fannie and Freddie from conservatorship.[7] “The government’s stake in the two mortgage giants could be valued at billions of dollars, meaning a spinoff would potentially net a big payday for the government and private investors in the two companies, said Ted Tozer, who led Ginnie Mae, a separate government-sponsored mortgage company, during the Obama administration.”[8]

Hedge fund managers John Paulson and Bill Ackman are participating in the background to help Trump and his cabinet release Fannie and Freddie. Paulson and Ackman have been vocal about their stakes in the two companies.[9] [10] According to FOX Business, Paulson’s investments in government-sponsored enterprises (GSEs) such as Fannie Mae “played a role in his dropping out of the Treasury Secretary contention,” suggesting it signals “a huge clue that privatizing the GSEs may be back on the table” for the incoming Trump Treasury.”[11]

Fannie Mae’s Earnings

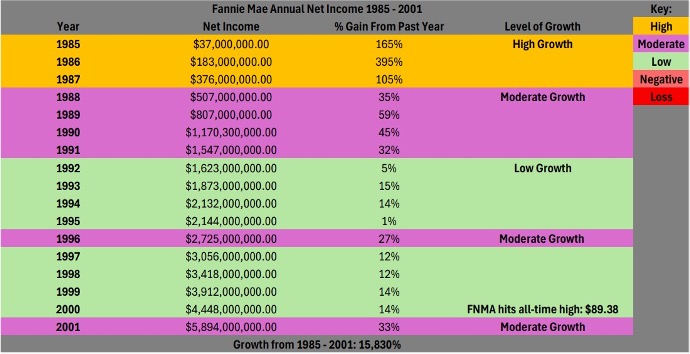

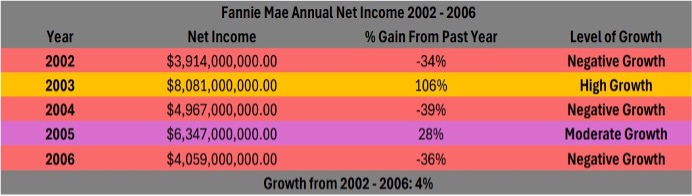

Below are tables of Fannie Mae’s annual net income from 1985 to 2023 for reference.[12] The tables are separated by time periods ranging from 1985 – 2001, 2002 – 2006, 2007 – 2011, and 2012-2023. The table includes the year, annual net income, percentage change from the prior year, and different periods of growth highlighted.

Exponential Potential?

There are two ways to plot data; linearly and logarithmically.

A linear scale has equal distance between each data point.[13] If exponential growth occurs between each data point, a linear scale will not display it accurately. Therefore, plotting data that grows exponentially on a linear scale will be meaningless.[14] Linear scales are used for precise measurement, not measurements that variate. A linear scale is used to display a map, nautical chart, engineering drawing, or architectural drawing.[15] Reading an improperly scaled map might lead one to the wrong destination.

A logarithmic scale does not have an equal distance between each data point. The spacing between each data point is not proportional, hence more suitable for unequal changes in data. Negative numbers are not plotted on a logarithmic scale, so all numbers are positive. The distance between data points is a multiple of a base number raised to a power. In other words, if exponential growth occurs, a logarithmic scale will display that growth. Logarithmic scales are better suited to plot large numbers that cover a large range.[16] This may include a company’s earnings, sound levels, or earthquake magnitudes.

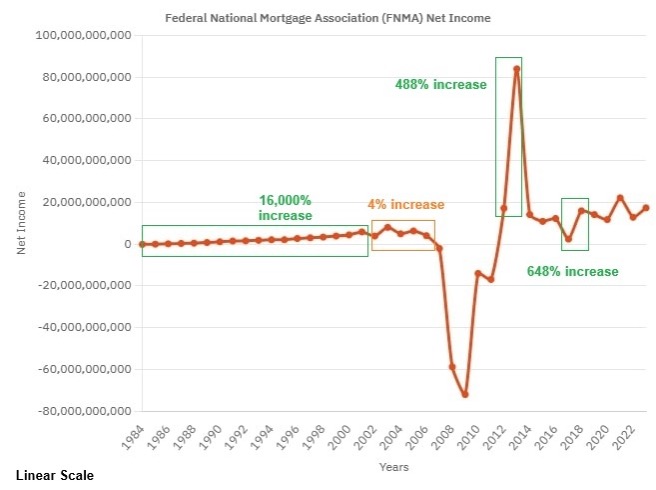

Fannie Mae’s annual net income from 1984 to 2023 is graphed below. The first graph is scaled linearly.

From 1985 to 2001, Fannie Mae’s net income grew from $37 million to $5.89 billion or approximately a 16,000% increase. The large percentage increase of 16,000% is barely noticeable on a linear scale. Smaller variations are difficult to view, such as between 2002 to 2006, when earnings only grew 4%. Also, the linear chart inaccurately displays the 488% gain as a larger line than the 648% gain.

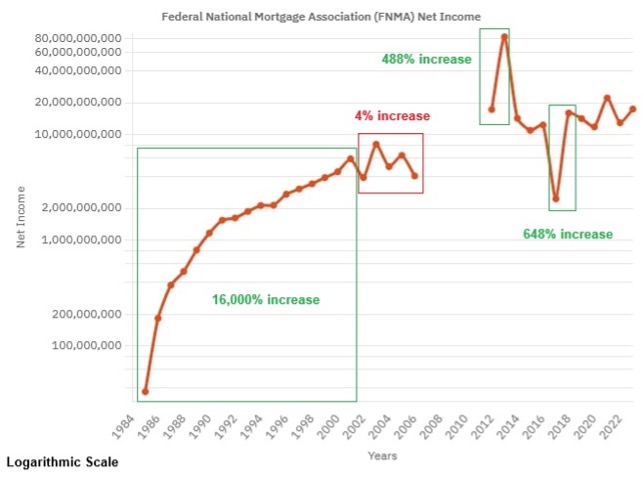

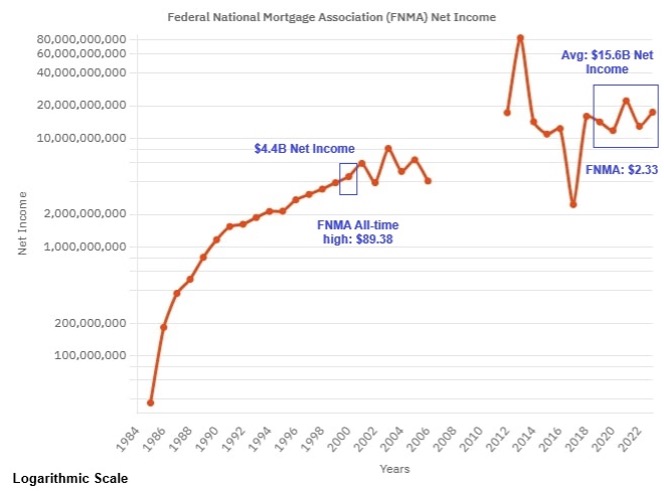

In contrast, the second graph below is scaled logarithmically.

As a result, the exponential rise from 1985 to 2001 is more prominently displayed. The variation in earnings from 2002 to 2006 is more visible. Logarithmic scales display only real numbers therefore the losses from 2007 to 2011 are not plotted. The change between 2012 and 2013 is not as pronounced versus the linear chart. This suggests the current earnings do not appear distant from the record profit-making year of 2013. Since the distance between each data point is based upon a percentage change, a logarithmic scale accurately displays the magnitude of a change in values. An example is from 2017 to 2018 when earnings went from $2B to $15.9B or a 648% increase. 648% is a larger line than 488% whereas on the linear chart it was incorrectly scaled by a large distance. In conclusion, the logarithmic chart scales Fannie’s earnings more accurately than the linear chart.

Using a logarithmic scale instead of a linear scale proposes the following conclusions about Fannie’s earnings. Fannie’s 5-year earnings dispersion lies at a higher level approximately 3 to 3.5x higher than in 2006 and prior. Fannie Mae traded at its all-time high of $89.38 in 2000. In 2000, Fannie Mae earned $4.4B. The average of Fannie Mae’s most recent 5-year earnings from 2019-2023 equates to $15.6B. In other words, Fannie Mae has earned 3.5x more than it did in 2000.

Which Price May Be Right?

Subnani Investment Research, LLC believes the price of Fannie Mae’s common shares should be higher than its all-time high of $89.38 considering the current earnings are 3.5x higher than when Fannie’s shares were trading at its peak. This represents an undervaluation of approximately 33x of the current market price. The firm believes the significant mispricing is a result of a market inefficiency. In economic theory, an inefficient market is one in which an asset’s prices do not accurately reflect its true value. “Market inefficiencies exist due to information asymmetries, transaction costs, market psychology, and human emotion, among other reasons. As a result of market inefficiencies, assets may be over- or undervalued in the market, creating opportunities for excess profits.”

Technical analysis is a method used in financial charting to determine trends of a stock. If market inefficiencies exist, technical analysis holds merit. The 200-day simple moving average is a key indicator that may provide potential entry and exit points or identify the direction of an overall trend. Fannie Mae’s price closed below the simple moving average in November 2007 at $38.42 during the real estate meltdown. This indicated a major bearish signal. However, in November, Fannie Mae closed at $3.13, significantly above the 200-day simple moving average of $1.86. The firm believes the close above the 200-day simple moving average is a bullish signal and an indication of a major reversal of the overall trend.

Below is a monthly chart of Fannie Mae dating from 1985 to present scaled linearly and scaled logarithmically. Stock prices do not move proportionately day-to-day.[17] Scaling the price data similarly to how the earnings were above yields a strikingly different appearance. The logarithmic chart scales the stock price based on percentage changes, whereas the linear chart scales based on whole numbers. When scaled linearly, the price of Fannie Mae’s stock seems stagnant for the past decade. However, when scaled logarithmically, the price has had large monthly percentage changes. The logarithmic chart better highlights when volatility is decreasing or increasing. While $90 may seem unattainably distant when scaled linearly, the logarithmic chart appears to shorten that distance.

Stock prices experience exponential changes therefore the firm expects the stock to recover faster than anticipated. The firm maintains its STRONG BUY rating and has a $90 price target. To become a client, contact Sanju via email at ssubnani@sinvestsllc.com.

[1] https://sinvestsllc.com/buy-rating-fannie-mae-fnma-0-43-otcmkts/

[2] https://sinvestsllc.com/update-strong-buy-fannie-mae-fnma-0-70-otcmkts/

[3] https://www.fhfa.gov/conservatorship

[4] https://www.bsfllp.com/news-events/bsf-prevails-at-trial-in-decade-long-battle-against-fhfa.html

[5] https://www.bsfllp.com/news-events/bsf-prevails-at-trial-in-decade-long-battle-against-fhfa.html

[6] https://assets.realclear.com/files/2021/11/1921_trump_letter_to_rand_paul.pdf

[7] https://www.mpamag.com/us/mortgage-industry/market-updates/will-trump-push-for-plans-to-privatize-fannie-mae-freddie-mac/516264

[8] https://amp.cnn.com/cnn/2024/12/02/economy/fannie-mae-freddie-mac-mortgage-rates-housing

[9] https://www.foxbusiness.com/politics/billionaire-trump-supporter-drops-out-running-treasury-secretary

[10] https://finance.yahoo.com/news/billionaire-investor-bill-ackmans-277-100000924.html

[11] https://www.foxbusiness.com/politics/billionaire-trump-supporter-drops-out-running-treasury-secretary

[12] https://www.fanniemae.com/about-us/what-we-do/financial-performance

[13] https://sciencezoneja.wordpress.com/2014/01/19/linear-vs-non-linear-scale/

[14] https://maxcandocia.com/article/2020/Aug/30/log-scale-zero-and-negative-values/

[15] https://en.wikipedia.org/wiki/Linear_scale#:~:text=A%20linear%20scale%2C%20also%20called,common%20element%20of%20map%20layouts.

[16] https://www.lrs.org/2020/06/17/visualizing-data-the-logarithmic-scale/

[17] https://www.claret.ca/publications/why-use-logarithmic-scale/